Shift Your Mindset,

Grow Your Wealth

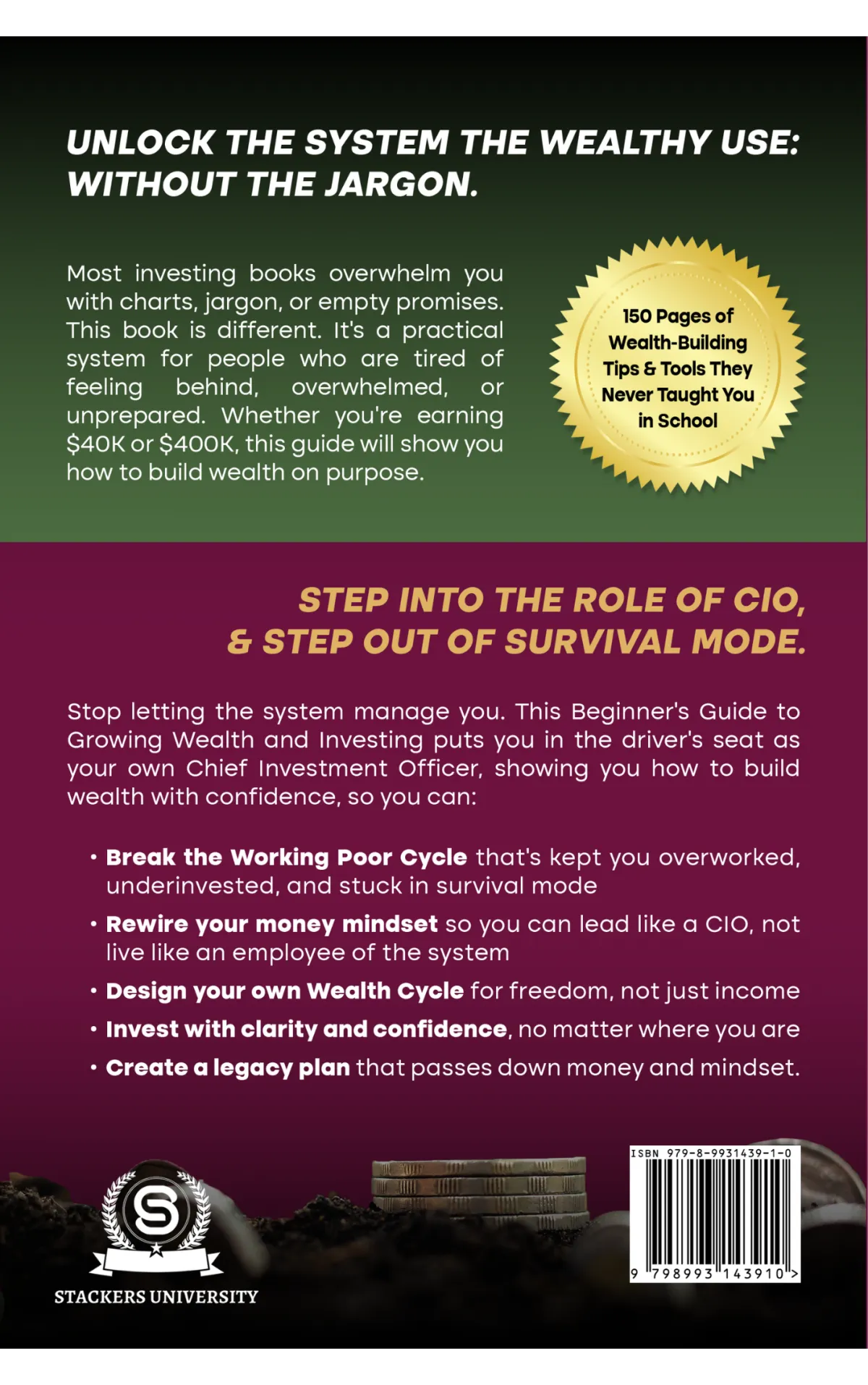

Discover The Beginner’s Guide to Growing Wealth and Investing

— the book that’s changing how people think about money.

You Were Never Taught How Money Really Works — But It’s Not Too Late.

The truth is, most of us were trained to work for money, — not make it work for us.

The Beginner’s Guide to Growing Wealth & Investing is more than a book, it’s a mindset shift. Dr. Stacker blends psychology, strategy, and real-life wisdom to help ordinary people break free from financial survival mode and start building wealth on purpose.

No jargon. No hype. Just the clarity, structure, and systems the school system never taught — delivered with the heart of a teacher and the honesty of your favorite Unc.

It doesn’t matter if you’re buried in debt, starting from zero, or just starting late — it’s not too late to plant the seed and let it grow.

Lead Your Finances Like a CIO, Grow Your Wealth Like a Gardener.

Are you tired of having more days in the month than you have money?

Is your money “funny,” but you aren’t laughing?

Are you sick and tired of being sick and tired?

If any of this sounds familiar, it’s time for a change. Our coaching programs give you the clarity, strategy, and support you need to break free from financial stress and build lasting wealth. No more guessing—just real, actionable steps toward the financial future you deserve. Let’s get started!

How the Guide Works

Stage 1: Laying the Groundwork – Step into your role as CIO (Chief Investment Officer) of your life.

Stage 2: Planting the Seeds – Learn how time, compound interest, and inflation shape everything.

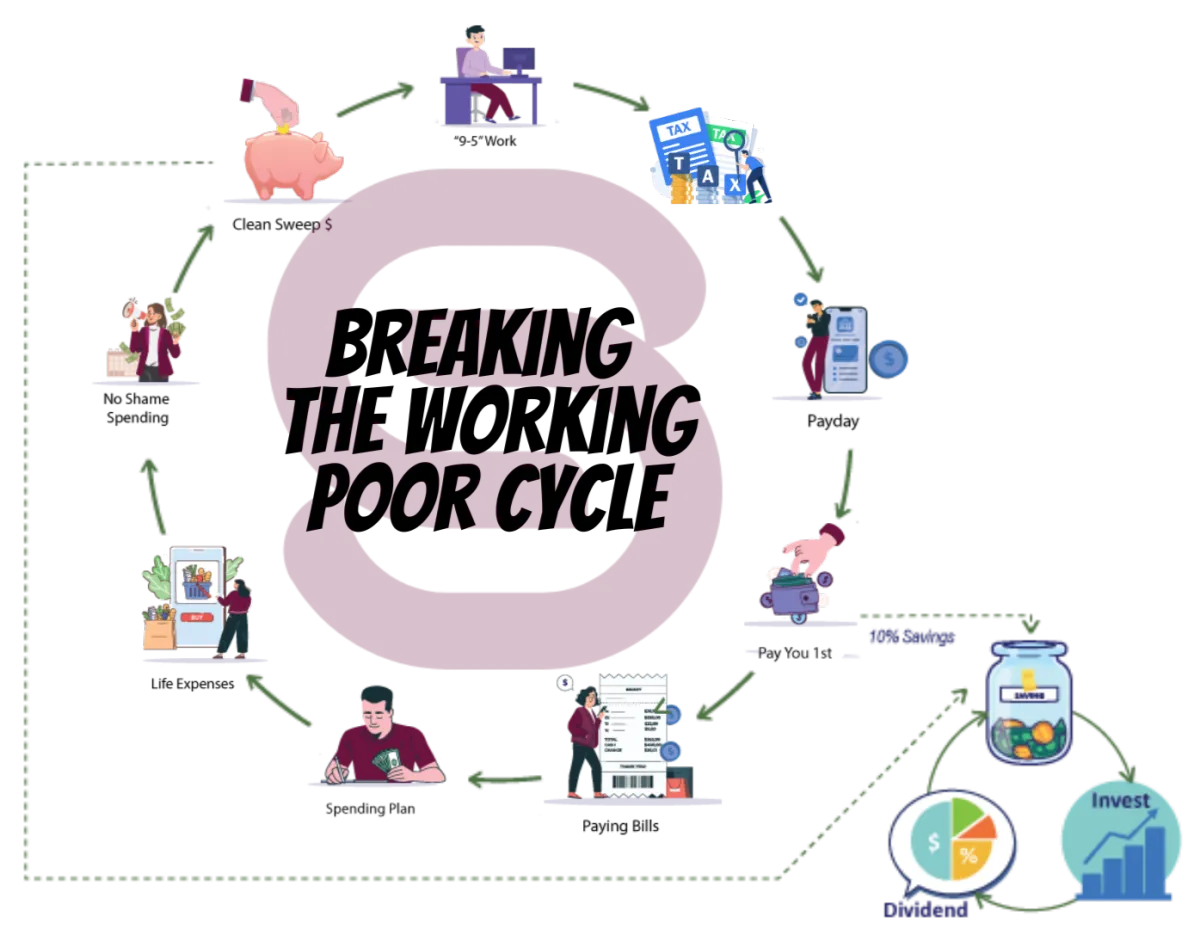

Stage 3: Building the System – Design your Wealth Cycle with automation and smart investing.

Stage 4: Weathering the Seasons – Build emotional resilience to survive market ups and downs.

Stage 5: Creating Your Wealth Cycle – Connect it all into a system that produces freedom and legacy.

Every chapter comes with:

CIO Insights – leadership lessons for your financial life

Belief Flips – new money mindsets that unlock growth

Tools & Prompts – practical steps you can use immediately

Using two powerful metaphors: you as the Chief Investment Officer (CIO) of your life, making high-level decisions that shape your future, and you as a gardener, planting seeds of action that grow into long-term wealth.

Both teach you how to build a system that works: one by strategy, the other by season.

As you move through these five stages, you’ll design a financial system that grows, adapts, and lasts for generations.

You don’t need more hustle, you need a Wealth Cycle

If You’ve Ever Wondered Why You’re Working Hard,

But Still Not Getting Ahead...You’re Not Alone.

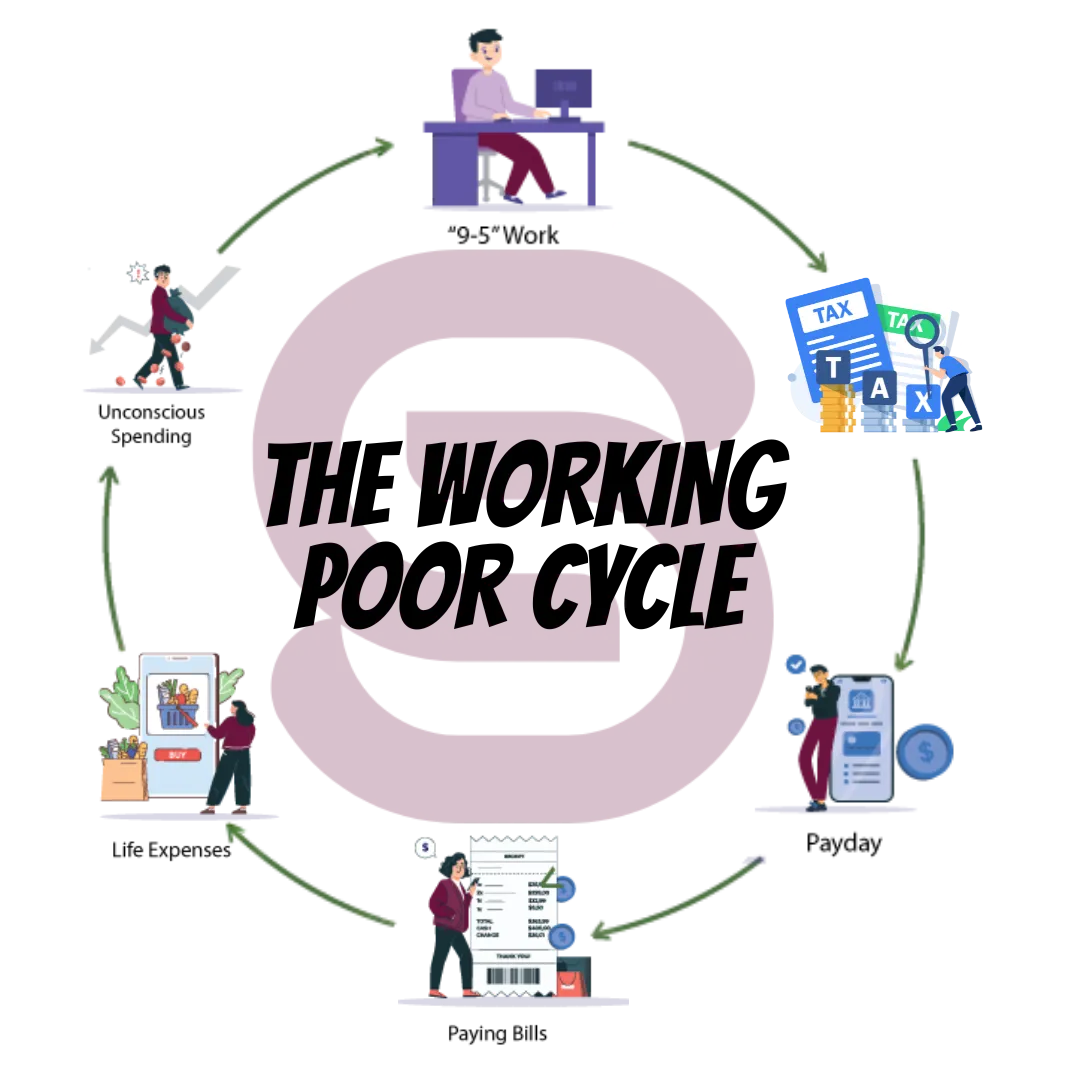

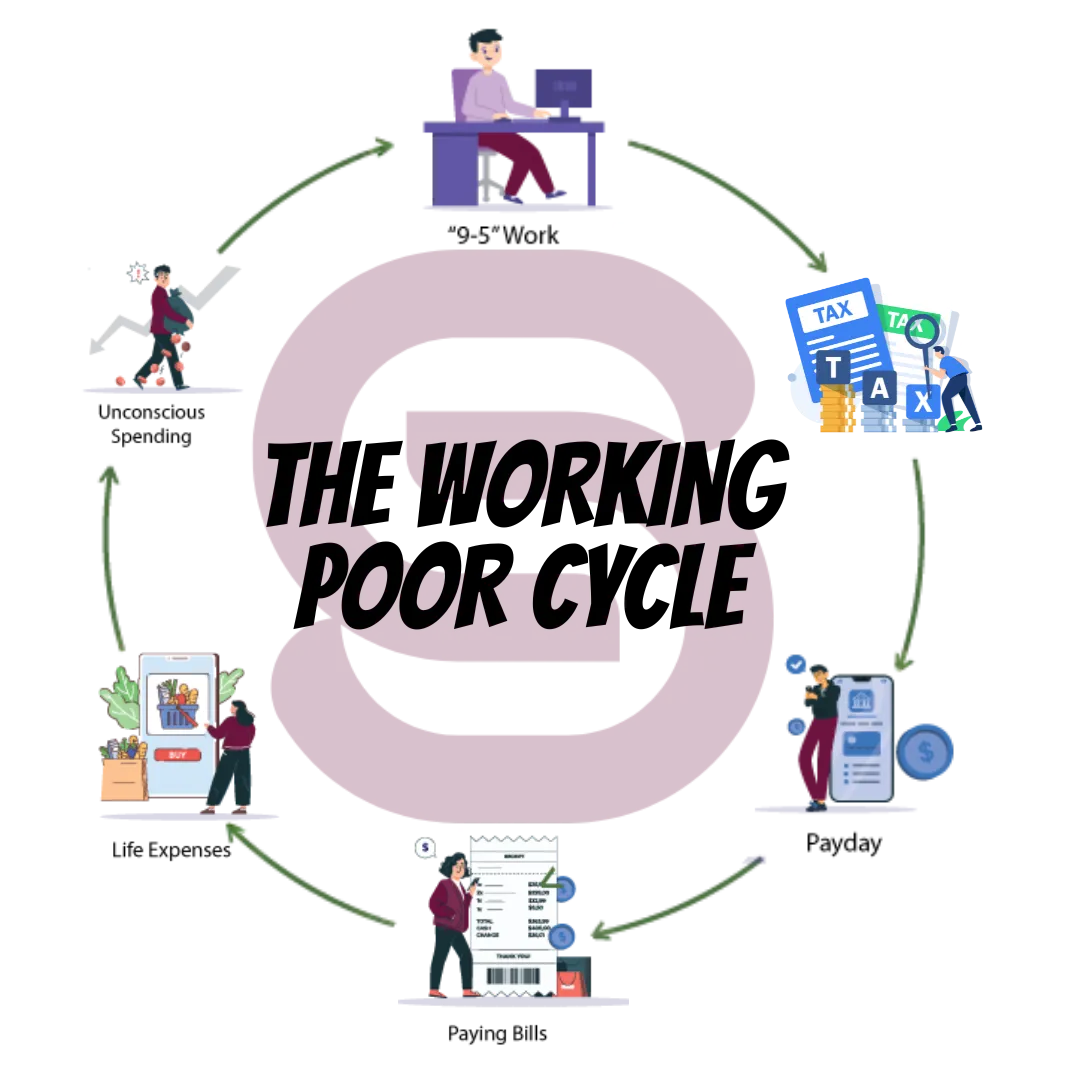

Most people were never taught how to build wealth, only how to survive.

You work, you earn, you pay bills…and somehow, it still feels like you’re running in place.

The truth? The system was built to keep you busy, not wealthy.

The rules of the game were hidden in plain sight: compound interest, cash flow, asset growth. All things they should’ve taught us in school

You don’t need to be rich to get started — you just need a strategy built for real life.

That’s why The Beginner’s Guide to Growing Wealth & Investing exists: to help you finally get off the hamster wheel and start moving forward.

Because wealth isn’t built by chance. It’s built by design.

We understand that managing finances isn't just about numbers; it's about creating a better life. Our holistic approach combines practical financial skills while addressing the emotional and psychological aspects of who you are to help you transform your relationship with money.

Our personalized coaching empowers you to addresses your unique challenges and goals. Whether you're struggling with debt, budgeting, or simply feeling overwhelmed, our program is designed to guide you toward lasting financial wellness.

Imagine a future where you're not just surviving paycheck to paycheck, but thriving, building wealth and living a life that truly reflects your values and aspirations. With Stackers University, you can stop just surviving and start thriving financially.

You don’t escape the system by working harder; you escape it by learning how it really works.

You can’t break the cycle until you understand the system behind it. And once you do — you’ll start building your own.

The “Working Poor Cycle” isn’t about laziness, it’s about lack of access. For generations, people have been taught how to earn, spend, and survive...but not how to build, grow, or protect. Inside this book, you’ll learn how to flip the script — from surviving off your paycheck to building a system that multiplies it. Nobody ever handed us the playbook, but page by page, this book will show you how to:

Treat every dollar like an employee, where their job is to bring back more employees.

Start mastering how you manage what you already make.

Use "TIME" as your superpower, because wealth isn’t built fast, it’s built consistently.

Find your “why” so you can let purpose become your profit plan.

Align your money with your values so every expense feels like progress,

Learn to invest with clarity, not chaos.

Build a system designed to outlive you — one that passes wealth, wisdom, and structure to the next generation.

Are you tired of having more days in the month than you have money?

Is your money “funny,” but you aren’t laughing?

Are you sick and tired of being sick and tired?

Who the Book is For

This isn’t for people who are “kinda interested.” It’s for people who are DONE living broke and confused. This guide is for you if:

You’re working hard but still feel like you’re running in place...Your paycheck comes in, your paycheck goes out...nothing remains.

You’re sick and tired of being sick and tired of your current situation.

Investing feels like a secret game everyone else knows how to play.

You’ve been knocked down financially by — debt, divorce, job loss, bad decisions — and you’re ready to rebuild for real this time.

You’re tired of waiting for “someday” and want a system that starts working right now.

You’re done guessing, done winging it, and ready to step up as the CIO of your financial life.

The Transformation

By the end of this guide, you won’t just “know about investing.” You’ll have a personalized Wealth Cycle in motion, a system that grows your money automatically. You’ll finally see the big picture clearly, with confidence and control.

You’ll stop just surviving. You’ll start thriving. You’ll build a legacy that outlives you.

What the Experts Are Saying About Dr. Stacker’s Beginner’s Guide…

"The Simple Path to Wealth meets Atomic Habits"

Where the clear, actionable investment wisdom of The Simple Path to Wealth meets the identity-shifting, system-building approach of Atomic Habits, you’ll discover Beginner's Guide to Growing Wealth and Investing, a book that doesn’t just tell you what to do with your money—it transforms how you see yourself in relation to it. Dr. Stacker blends JL Collins’ straightforward, index-fund-first philosophy with James Clear’s focus on small, consistent behavioral shifts, guiding readers to become the Chief Investment Officer of their own lives. The result is a guide that roots financial growth in mindset and daily systems, not just spreadsheets and stock picks."

Independent pre-publication review conducted March 2025.

Independent pre-publication review conducted March 2025.

Beginner’s Guide to Growing Wealth and Investing by Dr. Stacker is a structured, motivational manual that reframes personal finance as a journey of identity transformation and system-building, rather than a pursuit reserved for the wealthy or financially savvy. The book is organized into five progressive stages, each corresponding to a phase in gardening, guiding readers from internal mindset shifts to the practical establishment of generational wealth. The narrative is designed to move readers from passive consumers trapped in the “Working Poor Cycle” to empowered Chief Investment Officers (CIOs) of their own financial lives, ultimately fostering a sustainable, automated wealth-building system.

Beginner’s Guide to Growing Wealth and Investing by Dr. Stacker is a structured, motivational manual that reframes personal finance as a journey of identity transformation and system-building, rather than a pursuit reserved for the wealthy or financially savvy. The book is organized into five progressive stages, each corresponding to a phase in gardening, guiding readers from internal mindset shifts to the practical establishment of generational wealth. The narrative is designed to move readers from passive consumers trapped in the “Working Poor Cycle” to empowered Chief Investment Officers (CIOs) of their own financial lives, ultimately fostering a sustainable, automated wealth-building system.

Structurally, Beginner’s Guide to Growing Wealth and Investing is paced to move readers from introspection and belief change, through knowledge acquisition and system-building, to emotional resilience and legacy planning. Each stage builds logically on the previous, ensuring that readers do not advance to complex actions without a solid foundation. The recurring metaphors and actionable exercises reinforce the narrative arc, while the practical guides and automation strategies ensure accessibility. The payoff is a holistic transformation — both internal and external — that positions readers for lifelong financial growth.

Structurally, Beginner’s Guide to Growing Wealth and Investing is paced to move readers from introspection and belief change, through knowledge acquisition and system-building, to emotional resilience and legacy planning. Each stage builds logically on the previous, ensuring that readers do not advance to complex actions without a solid foundation. The recurring metaphors and actionable exercises reinforce the narrative arc, while the practical guides and automation strategies ensure accessibility. The payoff is a holistic transformation — both internal and external — that positions readers for lifelong financial growth.

Are you tired of having more days in the month than you have money?

Is your money “funny,” but you aren’t laughing?

Are you sick and tired of being sick and tired?

If any of this sounds familiar, it’s time for a change. Our coaching programs give you the clarity, strategy, and support you need to break free from financial stress and build lasting wealth. No more guessing—just real, actionable steps toward the financial future you deserve. Let’s get started!

About Dr. Stacker

Dr. Stacker — also known as Doc Stacker, Ph.D. — launched Stackers University and its YouTube channel in March 2022 with one mission: to provide the financial education the school system never did. Since then, Stackers University has grown to over 1.3 million views across 40+ countries, with nearly 300 educational videos, 11,000+ subscribers, and more than 30 sponsored collaborations. Doc’s channel has become a trusted resource for everyday investors around the world, with viewers tuning in from the United States, Canada, the U.K., Australia, India, and beyond.

Through trusted partnerships with Investing.com, Monetary Metals, PIMBEX, and Mint Mobile, Doc has built a platform that blends education, psychology, and strategy — turning complex financial ideas into practical, real-life systems anyone can use to build wealth on purpose.

Doc didn’t start wealthy. His financial journey began with just $5,000, and through hustle, discipline, and vision, he grew that seed into a multi-million-dollar real estate portfolio. On the outside, it looked like he had “made it.” But his financial house was built on sand. When the pressure hit, it all collapsed. He lost the portfolio, went deep into debt, and found himself trapped in the same cycle where even six-figure earners live paycheck to paycheck, broke, and enslaved by debt.

That collapse became the turning point. Out of failure, he rebuilt by cracking the code, discovering that wealth isn’t just about what you do, but who you become. As he says, “It’s not easy, but it is simple.” By transforming his mindset, mastering his emotions and aligning his identity with his financial goals, he created the Stackers University Wealth Cycle™, a system born from failure that helped him save $250,000 in just three years.

As an educator with nearly three decades in higher education as a professor and administrator, Doc Stacker brings together the rigor of academia, the insights of behavioral finance, the grit of lived experience, and the wisdom of someone who has walked the same hard road to wealth. With a Master’s in Counseling and a Ph.D. in Educational Leadership, he integrates psychology, emotion, and practical investing into a framework that changes lives.

Today, Doc teaches people how to break free from the Working Poor Cycle by focusing less on “tips and tricks” and more on identity transformation. Most financial advice gets stuck on surface-level hacks: budget harder, cut back, maybe even skip your daily latte as if that alone builds generational wealth. Doc knows the truth firsthand: the barrier isn’t knowing what to do, the barrier is becoming the kind of person who can actually do it. Once that shift happens, the actions take care of themselves.

His teaching blends personal finance, investing, and behavioral psychology into a practical playbook for anyone tired of surviving and ready to thrive. At the heart of his work is a conviction: the most valuable real estate in the world is the space between your two ears. When you lead like a CIO, plant like a gardener, and align your mindset with your money, you build wealth that lasts.

Ready to Break the Cycle?

Your financial life doesn’t have to feel overwhelming. You don’t need to guess. You don’t need to do it alone. The system is here…the Wealth Cycle works…and it’s waiting for you.

Meet The Coaches

Dr. Stacker

Founder and Educator

Dr. Stacker's approach to coaching is straightforward and focused on helping people take control over themselves before their finances. He combines practical financial knowledge with a deep understanding of how emotions and mindset affect financial decisions. His coaching style is direct and tailored to each person's needs, aiming to empower them to make informed decisions and build lasting wealth.

Dr. Stacker's Approach:

Experience: Over 30 years in education and 20 years in the investing and the financial industry

Focus: Mindset, building wealth and diversify wealth, particularly through precious metals and real estate

Approach: Straightforward, no-nonsense financial planning focused on mentality, focus and grit

Philosophy: Wealth starts in the mind

Tailored coaching: Suitable for both novice and experienced investors

Key Areas:

Changing mindset

Removing psychological and emotional barriers

Motivation and inspiration

Strategic asset allocation

Integrating precious metals into investment portfolios

Learn More About Dr. Stacker

Dr. Stacker, with more than 30 years in higher education, brings a unique approach to financial education. With a Ph.D. in Educational Leadership and a Masters in Counseling, he combines behavioral finance theory with practical investing experience to help people transform their financial lives. His financial journey taught him the hard way that wealth isn’t about the knowledge of what to do or your assets. Starting with $5,000 he purchased his first rental property and built it into a $2 million real estate portfolio. He then lost it ALL and as he says, “For almost a decade, I simply gave up.” His biggest takeaway was, wealth starts and ends in your mind and mindset.

As an accredited investor by the SEC, business owner and precious metals advocate, Dr. Stacker is particularly focused on “providing the financial education, the educational system didn’t provide.” Dr. Stacker is most known for his precious metals YouTube educational channel, Stackers University, but now his missions is to empower people to “Stop Surviving and Start Thriving” financially.

Professor Benjamin

Financial Educator

Professor Benjamin is a financial wellness coach specializing in helping women and couples manage their finances. Professor Benjamin combines expertise with understanding of unique challenges faced by women and couples in money management, providing tools and guidance for informed financial decisions.

Professor Benjamin's Approach:

Experience: Over 10 years in the financial industry

Focus: Empwering woomen and couples to control their financial futures

Philosophy: Financial confidence starts with education

Tailored approach: Customizes strategies to individual needs

Key Areas:

Breaking through barriers like imposter syndrome and financial anxiety

Budgeting, saving, and navigating major financial transitions

Goal: Create a supportive, judgment-free space for clients to achieve financial security and independence

Learn More About Professor Benjamin

Professor Benjamin is a dedicated financial wellness coach who specializes in empowering women and couples to take control of their financial futures. With over 10 years of experience in the financial industry, Professor Benjamin combines her expertise with a deep understanding of the unique challenges women and couples often face when it comes to money management. She believes that financial confidence begins with education and is committed to providing clients with the tools and guidance they need to make informed, sustainable financial decisions.

Having worked with clients across a variety of backgrounds, Professor Benjamin tailors her approach to meet the individual needs of each person or couple she works with. She helps women break through barriers such as imposter syndrome, financial anxiety, and lack of knowledge to confidently manage their finances. Whether it's budgeting, saving for the future, or navigating major financial transitions, Professor Benjamin works collaboratively with her clients to create clear, actionable steps toward financial security and independence. Her ultimate goal is to create a supportive, judgment-free space where women and couples can work toward their financial goals with clarity and confidence.

The Perfect Plan for Your Financial Future

Whether you’re looking for a one-time “cram session” or a longer-term transformation, we’ve got options to meet your needs:

1-Hour Cram Session

Perfect for tackling a specific issue or getting quick clarity on your next steps.

6-Week Program

A focused introduction to financial coaching with actionable strategies tailored to your goals.

10-Week Program

Dive deeper into shifting your mindset, curbing spending, and building long-term habits for success.

14-Week Program

The ultimate deep dive into mastering your finances and creating lasting change.

$197

Single 60-Minute Coaching Session

Discuss One Key Issue:

Financial Guidance

Money Mindset

Credit Portfolio Review

Budgeting

Precious Metals Investing

$597

6-Week Financial Foundation Reset Package

What's Included:

Financial Guidance

Money Mindset Shift

Set Financial Intentions

3 Live Coaching Sessions

Budgeting Basics

Expense Tracking & Adjustment

$947

10-Week Financial Transformation Package

What's Included:

Financial Guidance

Money Mindset Shift

Set Financial Intentions

5 Live Coaching Sessions

Budgeting Strategy

Debt Review

Credit Repair Guidance

Investing Overview

Tailored Financial Plan

$1297

14-Week Financial Mastery Package

What's Included:

Financial Guidance

Money Mindset Shift

Set Financial Intentions

7 Live Coaching Sessions

Goal Setting & Planning

Budgeting Strategy

Debt Consolidation Strategies

Credit Repair Plan

Investing Basics

Tailored Financial Plan

How It Works

Book a 1-Hour Coaching Session Anytime

You can jump straight into a 1-hour coaching session without the need for an initial consultation. Simply choose the topic you’d like to focus on, and we’ll dive right in—providing personalized, actionable advice tailored to your unique financial situation. Whether you’re looking to improve your money mindset, work on budgeting, or get credit repair guidance, we’ll provide the clarity and direction you need to make meaningful progress.

Our Comprehensive Coaching Packages Begin with an Application & Free Consultation

For our comprehensive coaching packages, the first step is to complete an application. We carefully review each application to ensure that we're a good fit and can genuinely help you achieve your financial goals. This step helps us make sure that our coaching is aligned with your needs and that we can provide the support you deserve.

Once your application is reviewed and accepted, we’ll schedule a free 20-minute consultation call with Dr. Stacker or Professor Benjamin. During this call, we’ll discuss your goals, challenges, and the best path forward based on your unique situation. From there, we’ll create a tailored coaching plan that sets you up for long-term financial success.

This process ensures that you’re receiving personalized, actionable guidance from the start, and that we’re clear on how to work together for the best outcome.

Consistency Is Key

We meet every other week to give you the additional time and space needed to apply the principles and strategies we cover during your coaching sessions. Most of us need time to unlearn outdated beliefs about money and ourselves that have been ingrained in us since childhood. That’s why our process is intentional, thorough, and designed for real results.

Coaching Isn’t for Everyone

This program is for individuals who are truly ready to commit to their financial transformation. Because of the level of dedication required, we carefully review all applications and reserve the right to accept only those who are ready to do the work.

Why Choose This Program?

Why Choose This Program? This isn’t just another financial coaching program—it’s an opportunity to completely transform how you think about money and create lasting results. If you’re ready to invest in yourself and take control of your financial future, we’d love to hear from you.

How It Works

Book a 1-Hour Coaching Session Anytime

You can jump straight into a 1-hour coaching session without the need for an initial consultation. Simply choose the topic you’d like to focus on, and we’ll dive right in—providing personalized, actionable advice tailored to your unique financial situation. Whether you’re looking to improve your money mindset, work on budgeting, or get credit repair guidance, we’ll provide the clarity and direction you need to make meaningful progress.

Our Comprehensive Coaching Packages Begin with an Application & Free Consultation

For our comprehensive coaching packages, the first step is to complete an application. We carefully review each application to ensure that we're a good fit and can genuinely help you achieve your financial goals. This step helps us make sure that our coaching is aligned with your needs and that we can provide the support you deserve.

Once your application is reviewed and accepted, we’ll schedule a free 20-minute consultation call with Dr. Stacker or Professor Benjamin. During this call, we’ll discuss your goals, challenges, and the best path forward based on your unique situation. From there, we’ll create a tailored coaching plan that sets you up for long-term financial success.

This process ensures that you’re receiving personalized, actionable guidance from the start, and that we’re clear on how to work together for the best outcome.

Consistency Is Key

We meet every other week to give you the additional time and space needed to apply the principles and strategies we cover during your coaching sessions. Most of us need time to unlearn outdated beliefs about money and ourselves that have been ingrained in us since childhood. That’s why our process is intentional, thorough, and designed for real results.

Coaching Isn’t for Everyone

This program is for individuals who are truly ready to commit to their financial transformation. Because of the level of dedication required, we carefully review all applications and reserve the right to accept only those who are ready to do the work.

Why Choose This Program?

Why Choose This Program? This isn’t just another financial coaching program—it’s an opportunity to completely transform how you think about money and create lasting results. If you’re ready to invest in yourself and take control of your financial future, we’d love to hear from you.

Package Details

Single 60-minute Coaching Session

Get focused, personalized guidance in a 60-minute session designed to tackle one key financial issue. Whether you're looking for clarity on money mindset, budgeting, or investment strategies, we'll dive deep into your specific concerns and provide actionable steps for improvement. Here are some examples of topics we can cover in our 60-minute session:

🧠 Money Mindset Shift: Gain insights into overcoming limiting beliefs around money, learn how to build a healthier relationship with finances, and unlock new ways to attract financial abundance.

💑 Couples Financial Assessment: Receive expert guidance on aligning financial goals with your partner, enhancing communication, and ensuring both partners are on the same page for budgeting and saving.

💳 Credit Portfolio Check-In: Get a thorough review of your credit profile, including tips on improving your credit score, understanding your credit report, and strategies for reducing debt.

📊 Budgeting and Money Management: Work through a quick budget tune-up, identify areas of improvement, and receive practical advice on reducing expenses, increasing savings, and mastering your financial plan.

⚖️ Precious Metals Investing Help: Learn the basics of investing in precious metals (gold, silver, etc.), how to assess market conditions, and whether this investment strategy aligns with your financial goals.

This 1-hour session is the perfect opportunity to get personalized advice and take actionable steps toward your financial success. Apply now and start making lasting changes!

6-Week Financial Foundation Reset

Transform your financial future with a structured, supportive coaching experience designed to build confidence and lasting habits. Over six weeks, you'll gain the tools, strategies, and accountability needed to take control of your finances with clarity and purpose.

What's included:

🧠 Money Mindset Shift – Explore and challenge your beliefs about money. Develop a positive, growth-oriented mindset that empowers you to make smarter financial decisions and attract abundance.

🎯 Setting Financial Intentions – Define your financial goals with clarity and purpose, creating a powerful vision for your financial future that aligns with your values.

📊 Budgeting Basics – Learn the essential skills for creating and managing a realistic budget that aligns with your goals, ensuring every dollar is put to work effectively.

📈 Tracking & Adjusting Your Expenses – Master the art of tracking your expenses and making adjustments when necessary to stay on track and make improvements as needed.

✅ Six-Week Accountability Plan – Create a detailed, six-week plan to track progress on your money mindset, budgeting habits, and financial goals. Stay accountable with built-in milestones.

With expert guidance and a supportive framework, this program helps you build financial confidence and long-term success. Ready to take the next step? Apply now!

10-Week Financial Transformation

Take your financial journey to the next level with a fully customized plan designed to help you master your money, eliminate debt, and build long-term wealth. This program goes beyond budgeting to provide personalized strategies for credit repair, debt reduction, and investing—ensuring you have the knowledge and tools to create lasting financial success.

What's Included:

🧠 Money Mindset Transformation – Develop a positive relationship with money by identifying limiting beliefs and shifting your mindset to attract financial opportunities and success.

📊 Personalized Budgeting Strategy – Create a customized budget plan tailored to your income, goals, and lifestyle, with clear steps to track and manage spending.

💳 Debt Consolidation Strategies – Explore debt consolidation options and create a roadmap to reduce debt faster, minimize interest, and regain financial freedom.

📈 Credit Repair Plan – Get a detailed analysis of your credit report, learn strategies to improve your credit score, and establish healthy credit habits for long-term financial health.

📉 Investing Overview – Understand the basics of investing, from stocks and bonds to retirement accounts, and receive guidance on building an investment strategy that fits your financial goals.

📞 Live Coaching Sessions (Money Mindset & Budgeting) – Participate in live coaching sessions where you'll receive personalized support, clear action steps, and practical advice on strengthening your money mindset and budgeting habits.

✅ Tailored Financial Action Plan – Leave the program with a clear, actionable financial plan that includes steps for improving your mindset, managing debt, building credit, and starting your investment journey.

This program is designed for those ready to break free from financial stress and step into financial empowerment. Start your transformation today!

14-Week Financial Mastery Program

Achieve complete financial confidence with a deep-dive coaching experience designed to transform your mindset, master your money, and build lasting wealth. This all-inclusive program provides expert guidance, personalized strategies, and hands-on support to help you take full control of your financial future.

What’s Included:

📊 Comprehensive Financial Overview – Get a thorough review of your current financial situation, identifying strengths, weaknesses, and areas for growth to create a solid foundation for your financial journey.

🎯 Goal Setting & Financial Planning – Learn how to set specific, measurable, and actionable financial goals, and build a strategic plan to achieve them, ensuring long-term success.

🧠 Money Mindset Mastery – Dive deep into your relationship with money and develop a growth-oriented mindset to overcome limiting beliefs and increase financial confidence.

💰 Budgeting Fundamentals – Establish a clear and realistic budget that aligns with your goals, ensuring every dollar is working effectively to support your financial vision.

💳 Credit Repair Action Plan – Receive guidance on how to improve your credit score, with actionable steps to fix errors, reduce debt, and build healthier credit habits.

📉 Debt Consolidation Strategies – Explore the best debt consolidation methods and create a step-by-step plan to manage and eliminate debt efficiently, minimizing interest and payments.

📈 Introduction to Investing – Learn the basics of investing, including different asset classes, risk management, and how to start building an investment portfolio tailored to your financial goals.

📞 7 Live Coaching Sessions – Engage in seven personalized live coaching sessions, providing you with dedicated time to discuss your challenges, receive expert advice, and get support in real time to stay on track.

✅ 14-Week Financial Growth Plan – Follow a structured 14-week plan with actionable tasks and milestones, designed to guide you through every aspect of your financial transformation from start to finish.

This is the ultimate program for those ready to fully commit to their financial success. Are you ready to transform your future? Apply below!

Driving Growth, Amplifying Impact

Throckmorton

I can honestly sat that you have one of the very best, most

educational channels on the internet. Your videos are not only tremendously valuable, but humorous and humble at the same time.

Frankie

You’re my number one TBH. I like your approach more than

other precious mental channel. More philosophical, more investing knowledge,

good life lessons, etc.

Ks Coins

You’re an inspiration for Stackers…a model other channels

SHOULD learn from. Not being a pumper of metals but an encourager.

Get In Touch

Email: [email protected]

Contact Dr. Stacker

[email protected]

Address

Office: 304 South Jones Blvd., Ste. 1038, Las Vegas, Nevada 89107

Assistance Hours

Mon – Sat 9:00am – 8:00pm

Sunday – CLOSED

Phone Number:

(702) 500-7684

Always Stack Smarter. Never Stop Learning.

© {2025} Stackers University LLC - All Rights Reserved